Life Insurance Policy

How It Works

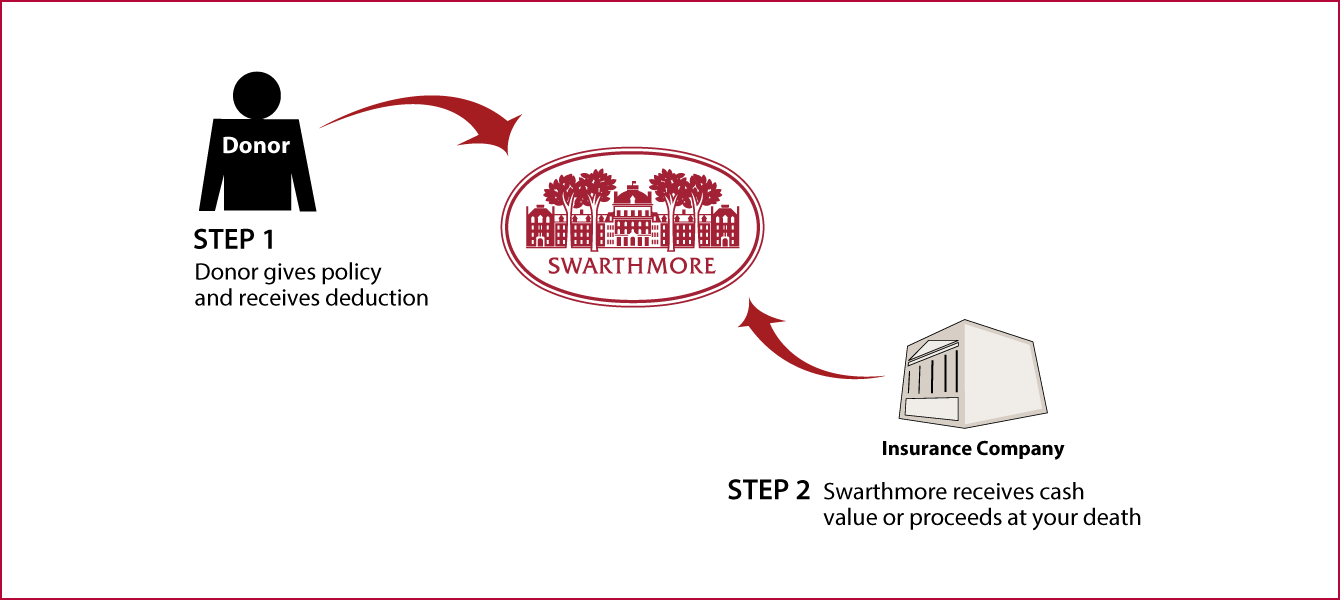

- You assign all the rights in your insurance policy to Swarthmore, designate us as irrevocable beneficiary, and then receive an income-tax deduction

- Swarthmore may surrender the policy for its cash value or hold it and receive the proceeds at your death

Benefits

- You receive a federal income-tax deduction

- If premiums remain to be paid, you can receive income-tax deductions for contributions to Swarthmore to pay these premiums

- You can make a substantial gift on the installment plan

- Swarthmore receives a gift they can use now or hold for the future

Request an eBrochure

Which Gift Is Right for You?

Contact Us

Renée P. Atkinson, CAP

Associate Vice President, Gift Planning

866-526-4438

giftplanning@swarthmore.edu

Swarthmore College

500 College Avenue

Swarthmore, PA 19081

Federal Tax ID Number: 23-1352683

© Pentera, Inc. Planned giving content. All rights reserved.

Disclaimer